As Q2 2021 draws to a close, markets have continued their trend of swinging between styles. The headlines in April read along the lines of ‘growth is dead, buy value/cyclicals’ but, since the turn of June, growth and Big Tech has shone again as the reflation trade wanes. The speed at which these rotations happen mean the trades are tricky to time and getting involved risks being whipsawed. At LGT Vestra, we are of the belief that owning quality companies is the best way to navigate this choppy period in markets.

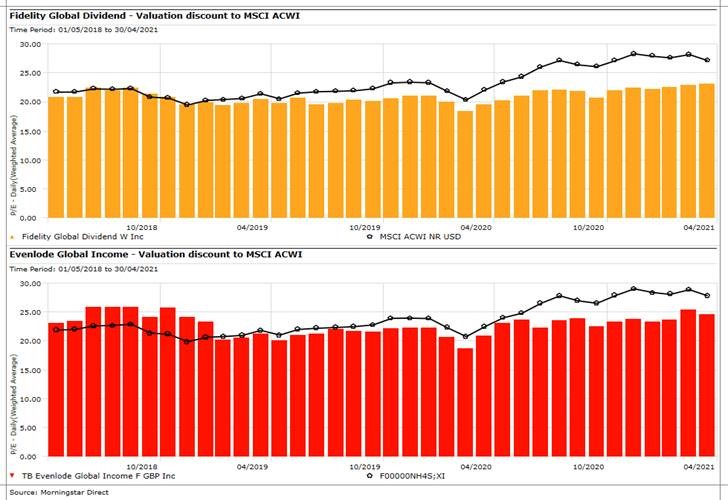

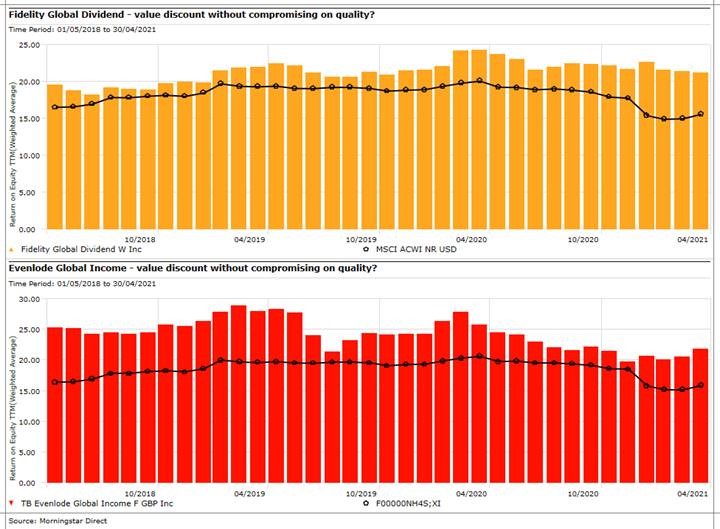

An area we have been focusing on recently is the so called “middle ground”, i.e. not growth nor value but those high-quality core investments that sit somewhere in the middle. Two funds we are favouring to play this theme are Fidelity Global Dividend and Evenlode Global Income. As we wrote in last week’s LGT Vestra Snapshot, we may be approaching a period of both ‘peak’ inflation and economic growth. Reliable income-generating assets such as dividend growers should benefit if interest rates do not rise much, the economic boom moderates and the inflation scare proves transitory. As rates will continue to be low investors will likely begin hunting for yields, whilst still wanting to hold safe assets, and that is where we see these types of funds adding value. Both funds own a number of ‘growth’ names whilst screening attractively from a valuation perspective. Figure 1 shows the Price/Earnings ratio relative to the index: both now trade at a discount to the index. Figure 2 shows Return on Equity relative to the index: both trading at a premium, indicating higher quality.

Figure 1: Price/Earnings Ratio Relative to Index

Figure 2: Return on Equity relative to index

These managers target the middle part of the investment spectrum seeking companies with good cash flows, strong balance sheets and the ability to grow and continue paying dividends. Dividend paying companies may also be the answer to a stuttering bond market. If bond yields continue to rise, with the Federal Reserve (Fed) signalling they will hike rates in 2023, then companies paying a sustainable, growing dividend are very attractive to investors. The type of companies that fall into this middle ground are typically insurance companies or pharmaceuticals, for example. Whilst they don’t have ‘tech’ in their name and may not appear to be racy investments, they are embracing technology, have progressive dividend policies and are strong, stable compounders.

Fidelity Global Dividend

Fidelity Global Dividend is a nod in the direction of value without going down the route of a deep value play. The fund seeks cross-cycle outperformance by investing in high quality, dividend paying companies. The manager, Dan Roberts, views himself as a contrarian bottom-up stock picker. He adopts a conservative investment approach focused on delivering a dividend based total return (yield and dividend growth) with an emphasis on capital preservation. As follows, the manager seeks companies with resilient return profiles, healthy balance sheets and dividend sustainability. The focus on quality characteristics coupled with a strict valuation discipline creates a portfolio that is ‘defensive’ with a skew to value.

Evenlode Global Income

The Evenlode manager focuses on identifying quality companies, defined as businesses able to generate sustainable growth over time with limited need to return to capital markets for reinvestment. This means investors can expect to see asset light business models with strong economic moats where customer purchase decisions are not predominately based on price. However, valuation risk is also key, and the manager employs a process called nudging. This involves incremental changes in response to the changing relative attractiveness. This investment process combined with current market conditions has led to a portfolio that screens as both higher quality and better value than the market.

We prefer these global equity income funds as the managers have flexibility to make top down asset allocation calls on which regions are looking the most attractive. They offer a combination of safety, growth and income whilst gaining exposure to high quality companies. These types of companies typically have pricing power and can pass rising costs onto consumers, such is the economic moat they have established. They are usually global brands with very strong balance sheets, high Return on Invested Capital and long-term compounders. As market oscillations between value and growth will likely continue throughout the second half of the year, we are quite happy being in the middle ground.